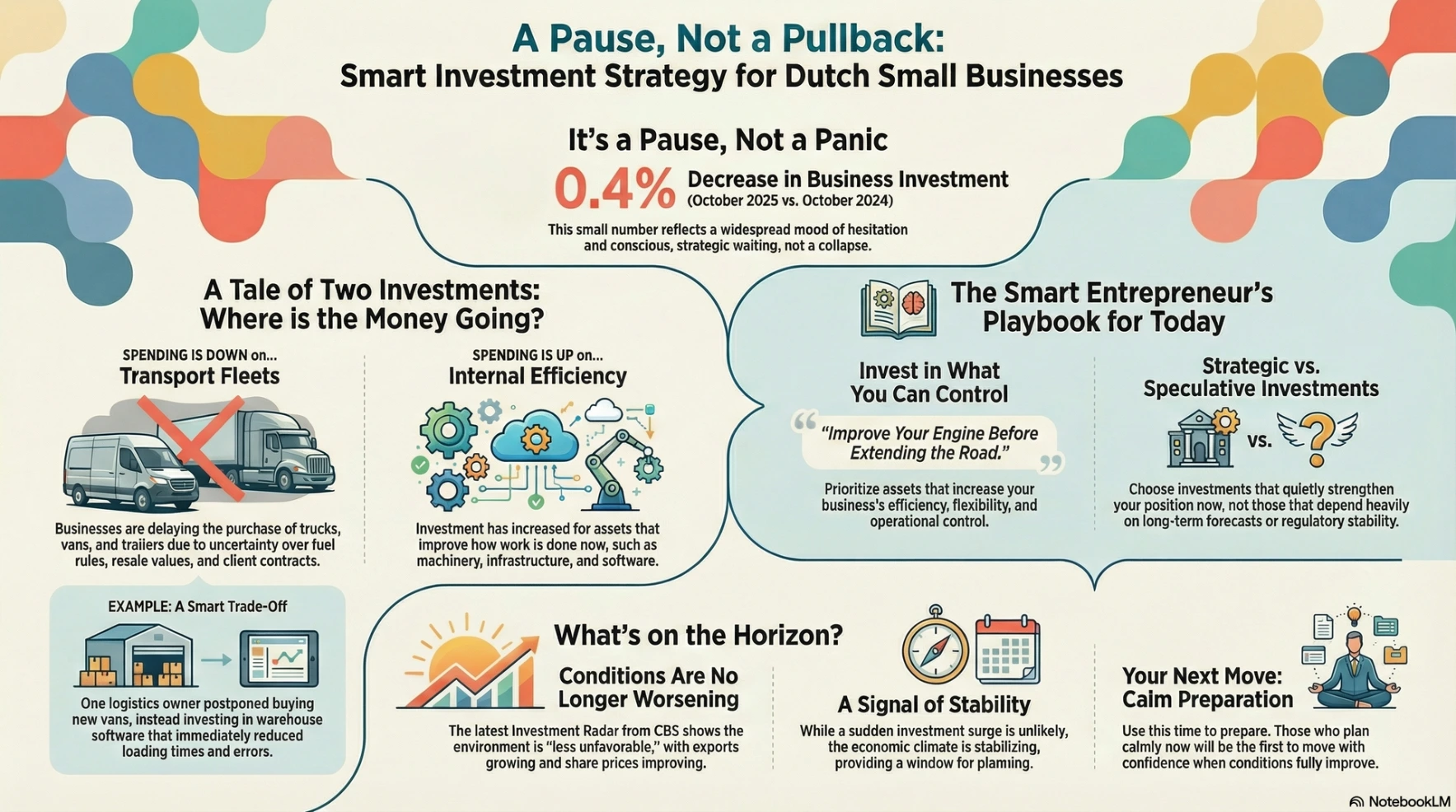

When Statistics Netherlands reported that investments in tangible fixed assets were 0.4 percent lower in October 2025 than a year earlier, the headline felt heavier than the number deserves. A fraction of a percent sounds technical, almost irrelevant, yet many small business owners will recognise the mood behind it. This was not about panic or collapse. It was about hesitation. About choosing to wait rather than to rush.

Behind the aggregate figure sits a very specific story. Investments fell mainly in trucks, vans, and trailers. At the same time, spending increased on machinery, infrastructure, and passenger cars. In plain language, businesses delayed replacing or expanding their transport fleets, while continuing to invest in tools, systems, and assets that improve how work is done. That distinction matters, because it tells us where confidence still lives.

I see this pattern every week. A small logistics entrepreneur I spoke with recently had planned to replace two delivery vans this autumn. The numbers worked, the bank was ready, but he postponed the decision. Fuel rules keep shifting, residual values feel uncertain, and clients are renegotiating contracts more often. Instead, he invested in new warehouse equipment and software that reduced loading time and errors. Less visible, less shiny, but immediately useful. The CBS numbers simply confirm that this logic is widespread.

October 2025 had the same number of working days as October 2024, so this is not a calendar illusion. It is a real comparison, shaped by real choices. Looking at the longer trend, investments have been moving up and down for years now, sometimes sharply. The past twelve months alone show strong rebounds followed by sudden dips. What we are seeing is not a straight line, but a cautious rhythm. Businesses step forward when clarity improves and pause when uncertainty clouds the horizon.

That is why the December Investment Radar from CBS deserves attention, even if it does not make headlines. Investment conditions are described as less unfavorable than they were in October. Exports are growing again compared to last year, and share prices have improved. This does not mean that investment will suddenly surge next month. CBS is careful about that, and rightly so. But it does signal that the environment is no longer deteriorating. For a micro-entrepreneur, that is often enough to start preparing, even if not yet committing.

The practical lesson here is not to chase optimism, nor to freeze in caution. It is to distinguish between investments that lock you into uncertainty and those that quietly strengthen your position. Many small businesses are still willing to invest, but they are doing so selectively. They choose assets that increase efficiency, flexibility, or control, rather than those that depend heavily on regulatory stability or long-term forecasts.

This is a sensible response to the times we are in. Not defensive, not reckless, but attentive. The data does not tell you what to buy. It tells you how others are thinking. And right now, many are choosing to improve their engines before extending the road.

A 0.4 percent decline is not a verdict on the economy. It is a snapshot of collective restraint. For those running small businesses, that restraint can be a strength, as long as it remains conscious rather than fearful. Calm preparation often matters more than bold expansion. And when conditions quietly improve, those who prepared are usually the first to move with confidence.

Paolo Maria Pavan

Head of GRC | Market Analyst

Paolo Maria Pavan is a Governance, Risk & Compliance strategist and market analyst known for turning complexity into operational clarity. He works with freelancers, founders, and established SMEs, helping them translate governance discipline, market intelligence, and economic signals into structured execution and defensible growth.