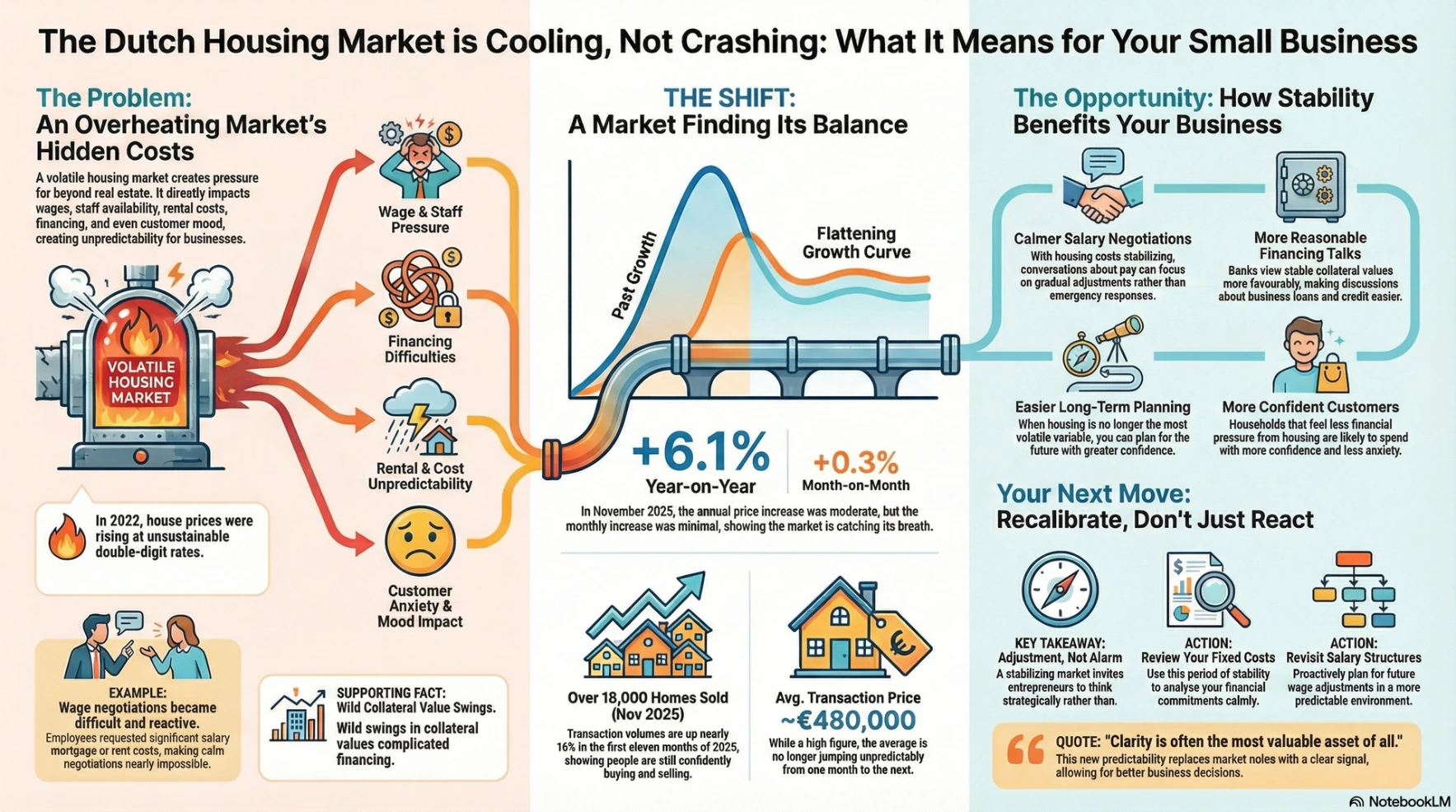

In November 2025, existing home prices in the Netherlands were on average 6.1 percent higher than a year earlier. That number sounds familiar by now, almost routine. What matters more is what sits behind it: for the eighth month in a row, the pace of price increases has slowed. Month to month, prices rose by just 0.3 percent. No spike, no shock. Just a market that seems to be catching its breath.

For many small business owners, housing figures feel distant, something for economists, homeowners, or politicians. Yet housing quietly shapes daily business reality. It influences wages, staff availability, rental costs, financing conversations with banks, and even the mood of customers. When the housing market overheats, pressure leaks into every corner of the economy. When it steadies, something else happens: expectations reset.

To understand why this matters, it helps to step back a few years. In 2022, house prices were rising at double-digit rates. That period ended abruptly. Prices dipped through much of 2023, only to start climbing again from mid-2023 onward. Today, prices sit nearly 15 percent higher than their previous peak in mid-2022. But the curve has changed shape. Growth is no longer accelerating. It is flattening.

This flattening is the real story. A housing market that grows more slowly is not a weak market. It is a market that becomes predictable again. Predictability is not exciting, but it is extremely useful for entrepreneurs.

Consider a simple, everyday scenario. You run a small consultancy or shop. One of your employees asks for a salary adjustment because their mortgage costs have risen sharply over the past two years. Until recently, that conversation was almost impossible to resolve calmly, because housing costs felt like a runaway train. Now, with prices stabilising, future increases look less dramatic. That does not solve affordability overnight, but it changes the tone of negotiations. It allows both sides to talk about gradual adjustments rather than emergency responses.

The transaction numbers support this calmer picture. In November alone, more than 18,000 homes changed hands, slightly more than a year earlier. Over the first eleven months of 2025, transactions were up nearly 16 percent year on year. This tells us that people are not frozen by fear. They are moving, buying, selling, adjusting. A functioning housing market is one where people make decisions, even if they are cautious ones.

The average transaction price now sits just under 480,000 euros. That number can feel abstract, and for many it feels unreachable. But it is important to remember that this average does not tell the whole story. It does not adjust for quality differences, location, or type of home. What it does signal is that prices are no longer jumping unpredictably from one month to the next.

For micro and small business owners, the practical implications are subtle but important. Financing conversations with banks tend to become more reasonable when collateral values stop swinging wildly. Long-term planning becomes easier when housing costs are no longer the fastest-moving variable in the equation. Even customer behaviour shifts. When households feel less pressured by sudden price surges, they spend with a little more confidence and a little less anxiety.

This is not a moment for celebration, nor for concern. It is a moment for adjustment. A stabilising housing market invites entrepreneurs to recalibrate rather than react. It is a good time to review fixed costs, revisit salary structures, and think calmly about long-term commitments instead of short-term fixes.

Housing markets do not move in straight lines, and no one should expect prices to stand still forever. But for now, the numbers tell a simple, reassuring story. The market is cooling, not collapsing. For those running small businesses, that distinction makes all the difference. It replaces noise with signal, and urgency with perspective. And in business, clarity is often the most valuable asset of all.

Paolo Maria Pavan

Head of GRC | Market Analyst

Paolo Maria Pavan is a Governance, Risk & Compliance strategist and market analyst known for turning complexity into operational clarity. He works with freelancers, founders, and established SMEs, helping them translate governance discipline, market intelligence, and economic signals into structured execution and defensible growth.